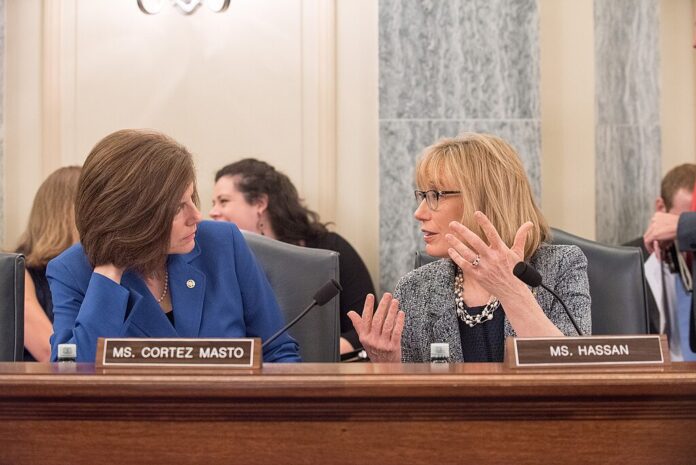

United States Senator Catherine Cortez Masto (D-NV) is leading a group of Democrats in demanding that the Trump administration’s top derivatives regulator explain how it plans to combat insider trading, manipulation, and fraud in prediction markets.

In a letter dated January 11, the senators asked Commodity Futures Trading Commission (CFTC) Chair Michael Selig, who was sworn in on December 22, to provide them with details on how the agency monitors suspicious event contract trading and what tools it uses to identify misconduct.

The move comes just over a week after a trader on Polymarket entered a position on Venezuelan President Nicolás Maduro leaving office shortly before President Trump announced U.S. Special Operations Forces had detained him. The timely bet resulted in the trader earning more than $400,000 on an initial wager of just over $30,000.

Pointing to the Maduro trade, the senators wrote, “This improbable increase in trades against Maduro’s continued authority in Venezuela mere hours before Maduro’s capture exemplifies the dangers of unregulated gaming and raises national security concerns.” The letter also describes other unusual activity on the platform, including Polymarket opening a contract on whether Maduro would be in U.S. custody by January 31, only an hour and a half before the news was made public.

Cortez Masto and her colleagues used the episode as an example of how event-based contracts can be exploited as a vehicle for insider trading, while also highlighting the national security concerns associated with markets that involve military options and sensitive foreign policy developments.

Torres Bill Set Stage for Prediction Market Oversight

Democrats have been weighing their options for stricter oversight of prediction markets ever since the Maduro trade made national headlines. Last Friday, Rep. Ritchie Torres (D-NY), joined by 30 other congressional Democrats, introduced the Public Integrity in Financial Prediction Markets Act of 2026.

The bill would combat insider trading by making it illegal for federal officials to trade event contracts on government policy, government action, or political outcomes if they “possess material nonpublic information” or “may reasonably obtain such material nonpublic information in the course of performing official duties.”

The concerns Torres outlined in the bill are, in many ways, similar to the issues the senators raised in their letter. However, the senators went further, drawing a clear distinction between prediction markets and legal sportsbooks. They pointed out that regulated sportsbooks have integrity monitoring systems and “a long history of alerting regulators and law enforcement of betting irregularities.”

The senators argue that these safeguards are missing from CFTC-regulated, as well as unregulated, prediction markets, despite some platforms, such as Kalshi, banning insider trading. In fact, Kalshi’s CEO, Tarek Monsour, has publicly backed Torres’ bill. It is important to note that the Maduro trades in question were placed on Polymarket’s international platform, not its CFTC-regulated prediction market.

Lawmakers Demand Clarity on CFTC Oversight

The senators asked the CFTC a series of pointed questions about its oversight of prediction markets, including:

- Have CFTC-regulated exchanges listed similar contracts to Polymarket relating to Maduro’s capture?

- Are there other instances of suspicious trading of Maduro-related event contracts facilitated through U.S.-registered DCMs?

- When Polymarket US fully launches, how will the CFTC ensure its event contracts comply with all relevant rules and regulations, particularly 17 CFR § 40.11 and 7 U.S. Code § 9 (which address event contract approval and anti-fraud enforcement)?

- According to Polymarket US Rulebook, “no person shall take action or direct another to take action based on non-public Order information, however acquired.” How will the CFTC ensure Polymarket US complies with this provision?

- How does the CFTC monitor suspicious trading activity in event contracts? If so, what is the process for identifying and remedying insider trading?

Lawmakers have asked that Selig respond on or before February 9. Besides Cortez Masto, signatories include Sens. Chris Van Hollen, Jacky Rosen, Elissa Slotkin, Andy Kim, Peter Welch, Adam Schiff, Jeff Merkley, Cory Booker, John Hickenlooper, Richard Blumenthal, and Alex Padilla.