The Q2 2025 earnings season rolled on last week, with major gaming companies, Rush Street Interactive, MGM Resorts, and Caesars Entertainment, releasing their financial results.

While gaming stocks ended the week with mixed performance, the Roundhill Sports Betting & iGaming ETF (NYSE: BETZ) outperformed the broader S&P 500 Index.

The broader markets experienced a sell-off last week amid the Federal Reserve’s hawkish stance, tepid US jobs data, and tariff threats from President Donald Trump.

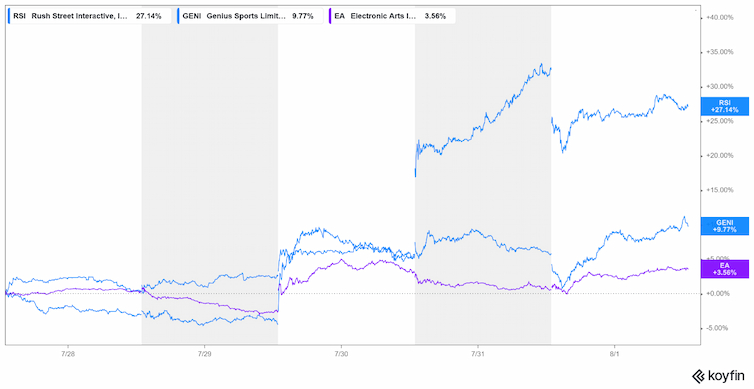

Rush Street Interactive and Genius Sports were among the major gainers last week, while Skillz, Star Entertainment, and Caesars Entertainment saw double-digit declines.

Top Gaming Stock Gains

Rush Street Interactive (NYSE: RSI): +27.2%

With gains of 27.2%, Rush Street Interactive was the biggest gainer in our coverage of gaming stocks. The sharp rally, which helped expand the stock’s year-to-date gains to an impressive 41%, was driven by the Q2 earnings beat.

The second quarter, which marked the ninth consecutive quarter with growth, Rush Street’s revenues rose 22% to $269.2 million, ahead of consensus estimates and a quarterly record for the company.

The bottom line results were also impressive, with Adjusted EBITDA up by 88% YoY, and the EPS landed at $0.11, almost double the $0.06 that analysts were expecting.

The company also improved its 2025 revenue and EBITDA forecasts, with midpoints implying a year-over-year rise of 16% and 51%, respectively, on these metrics.

The company’s monthly active users in the combined US and Canada market rose 21%, while the corresponding increase in Latin America users was 42%.

Genius Sports (NYSE: GENI): +9.7%

Genius Sports shares experienced a 9.7% increase last week, rising to a 52-week high. That marked a substantial bounceback, as in the preceding week the stock dropped 6.4%.

A few strategic partnerships announcements led the rise. On Wednesday, Genius Sports collaborated with PMG, which represents brands like Nike and TurboTax. Under the agreement, PMG will become a founding agency partner of Genius Sports’ premier fan activation platform, FANHub.

On Friday, Genius Sports announced that it has secured exclusive betting data rights for a select group of competitions in European football leagues.

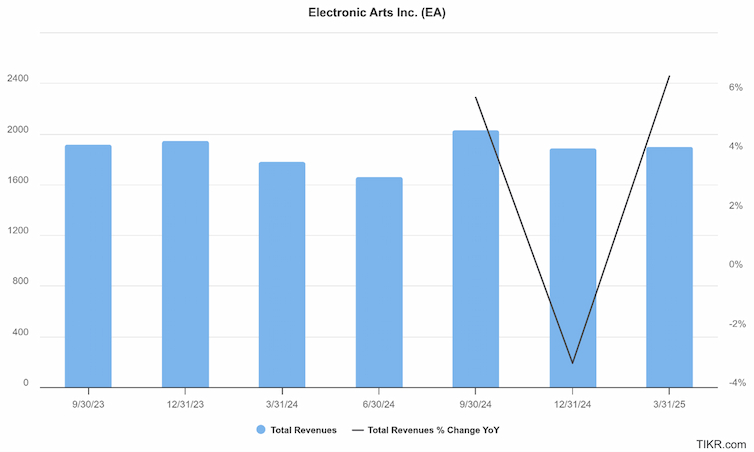

Electronic Arts (NASDAQ: EA): +3.6%

Electronic Arts was among the other major gainers, rising 3.6% last week. The company posted better-than-expected earnings in its fiscal Q1 2026 ending June 30, which helped drive the stock higher. After the report, brokerages including Benchmark, Wedbush, and Oppenheimer raised the stock’s target price.

Playtech (LON: PTEC): +3.0%

Gambling software operator Playtech Plc gained 3% last week. The company released its interim results and trading update, which included an encouraging statement:

“Since the AGM trading statement on 21 May 2025, the Company has delivered a strong performance underpinned by good momentum across our B2B business and a better than expected contribution from income from associates.”

Playtech expects its adjusted EBITDA in the first half of the year to be at least €90 million, which. Although it would be significantly below the £243.0 million (€279 million) posted in the corresponding period last year, it still exceeds analysts’ expectations.

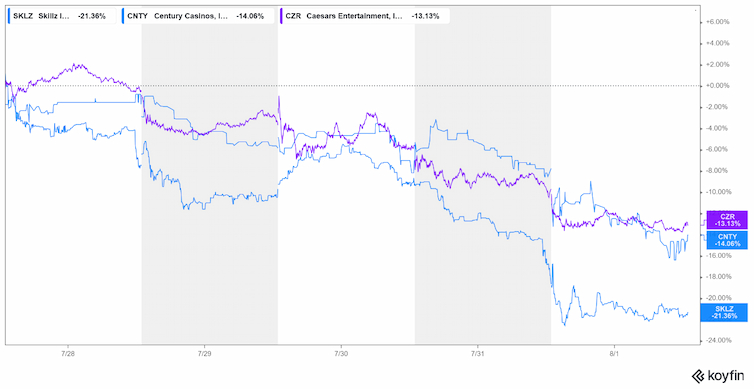

Largest Gaming Stock Losers

Skillz (NYSE: SKLZ): −21.4%

Skillz fell a whopping 21.4% last week. The stock is quite volatile, oscillating between the biggest gainers and losers. For context, it gained 22.3% in the week ending July 25 amid the surge in meme stocks, while losing 7% two weeks prior.

Skillz was part of the 2021 meme stock mania and has participated in the recent meme stock frenzy. Despite last week’s drawdown, the stock is up over 33% for the year.

That said, Skillz faces significant headwinds. The company’s paying monthly active users have fallen by over 41% over the last two years, and its $135 million market capitalization places it in microcap territory.

These factors, coupled with low trading volumes, make Skillz stock susceptible to significant price fluctuations, particularly in the absence of substantial company-specific news.

This week will be significant as the company reports its Q2 earnings on August 7.

Star Entertainment (ASX: SGR): −20.0%

Star Entertainment Group was the second-worst performer, losing 20% of its value last week. The fall was directly linked to the collapse of its plan to sell its 50% stake in its Queen’s Wharf Brisbane casino to Hong Kong-based partners Chow Tai Fook Enterprises and Far East Consortium.

As a result, the Australian operator must pay A$41 million back to its partners by September 5. Additionally, it must pay A$200 million in future equity contributions and is responsible for A$1.4 billion to cover its share in the project’s debt.

The stock fell to its all-time low last week and is now down over 51% in 2025 and 84% in the past 12 months.

Century Casinos (NASDAQ: CNTY): −14.1%

Century Casinos was among the other notable losers and fell 14.06% last week. While there wasn’t any major company-specific news last week, the broader market sell-off seems to have triggered investors to sell Century’s stock.

The stock has been quite volatile this year, and while it has jumped sharply from the 52-week low of $1.30 it hit amid the April sell-off, it is still down 32.1% for the year. Analysts, meanwhile, see the stock more than doubling over the next year.

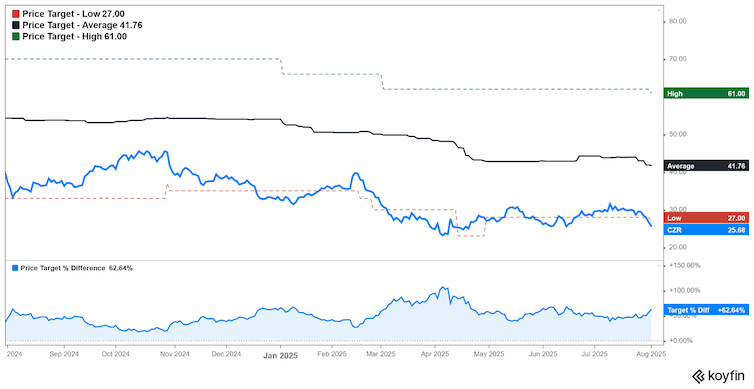

Caesars Entertainment (NASDAQ: CZR): −13.3%

Despite beating revenue forecasts and posting strong digital growth in Q2, Caesar Entertainment’s stock fell 13.3% last week. That was a result of disappointing earnings per share (EPS) of -$0.39 per share, compared to a consensus expectation of $0.06 profit per share.

Several brokerages, including Macquarie, JMP Securities, Susquehanna, Truist, and Barclays, slashed Caesars Entertainment’s target price following its Q2 earnings report, which further added to the pessimism.

Playtika (NASDAQ: PLTK): −8.6%

Playtika continued its downslide for the third consecutive week and shed 8.6% of its market capitalization last week. The stock is now down 39% for the year amid concerns that the company’s user base is shrinking due to its reliance on older mobile game titles and questions about long-term growth prospects.

Playtika is set to release its Q2 earnings on August 7, where it is expected to report a 10% annual decline in its adjusted EPS. The company’s earnings fell year-over-year in the previous three quarters, and Q2 looks set to be the fourth consecutive quarter of earnings decline.

The company is headquartered in Israel, and global socio-political tensions relating to regime and the ongoing conflict could also be reflected in the stock’s poor performance.

Other Major Gaming Industry Developments

MGM Resorts International released its Q2 earnings last week, delivering better-than-expected results. The company posted $4.4 billion in revenue (up by 2%) and adjusted EPS of $0.79, easily topping the $0.55 analysts’ estimates.

However, the earnings beat failed to uplift sentiment as widening losses in the online betting business overshadowed an otherwise strong earnings report.