Gaming stocks had a relatively uneventful week, and while the Roundhill Sports Betting & iGaming ETF (NYSE: BETZ), which invests in a basket of gaming companies, closed slightly in the green, it underperformed the S&P 500 Index for the third consecutive week.

Zeal Network and Robinhood were among the major gainers last week. Meanwhile, Betr Entertainment and Codere Online underperformed.

Largest Gaming Stock Gainers

Zeal Network Se (DAX: TIMA.D.DX) +8.8%

Zeal Network was the largest gainer in our coverage of gaming stocks and rose 8.8% last week, the bulk of which came on Friday. There wasn’t any major company-specific announcement last week, but the stock crossed over its 50-day moving average, which is a bullish technical indicator. The stock was among the major gainers in the preceding week as well, and has now nearly recouped its 2025 losses.

Notably, Zeal Network, the largest online lottery company in Germany, has been working on strategic partnerships to expand its reach.

In July, it partnered with Greentube, the digital gaming subsidiary of Novomatic, to integrate select Greentube online games into its portfolio for its German B2C brands, LOTTO24 and Tipp24.

The same month, its investment arm ZEAL Ventures announced a co-investment in Random State, a Swedish iLottery and iBingo specialist.

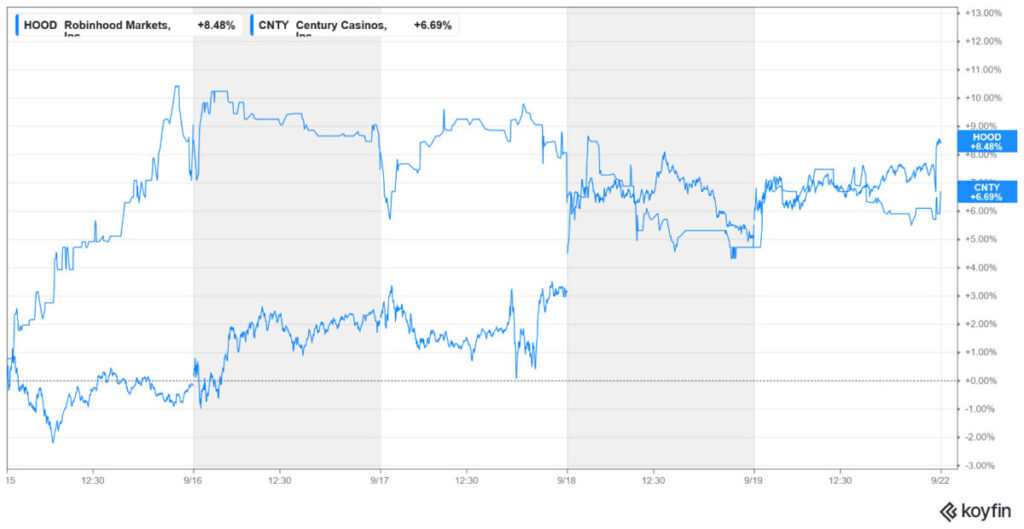

Robinhood Markets (NYSE: HOOD): +8.5%

Retail trading app Robinhood, which has been aggressively expanding into prediction markets, was among the biggest gainers last week, rising 8.5%. Notably, the U.S. Federal Reserve slashed rates by 25 basis points last week, and the dot plot called for two more rate cuts of a similar magnitude by the end of this year. While the rate cut was largely expected, it triggered a buying spree in financial and fintech names like Robinhood.

Moreover, the gains were attributable to Robinhood’s inclusion in the S&P 500 Index effective today. The world’s most popular index, which had overlooked Robinhood on several occasions this year, finally decided to add the stock. It’s usual for stocks to rise after getting included in the index, as addition means that passive funds actively tracking the S&P 500 index would necessarily need to buy the shares in the same percentage as in the index.

Century Casinos (NYSE: CNTY): +6.7%

Century Casinos made it to the list of major gainers last week, which is a welcome break for investors, as the stock fell 8.3% in the preceding week, which was the highest among the gaming stocks that we cover.

The stock has been quite volatile this year, and while it has risen from the 52-week low of $1.30 it hit amid the April sell-off, it is still down 16.4% for the year. CNTY is a loss-making microcap company with a market capitalization below $100 million, with little trading volume and a beta of over 2x, which makes it susceptible to wild price swings and is therefore a risky bet.

Largest Gaming Stock Losers

Betr Entertainment Limited (ASX: BBT) -10.9%

With losses of 10.9%, Betr Entertainment was the biggest loser in our coverage of gaming stocks. The stock has been quite volatile in recent weeks amid its proposed acquisition of PointsBet, where it is engaged in a bidding war with Japanese tech firm MIXI.

PointsBet’s board has recommended that investors opt for MIXI’s offer and has taken actions that Betr has challenged, such as the vesting of performance shares. PointsBet has highlighted Betr’s Entertainment’s negative free cash flows as one of the reasons for rejecting its bid, a move Betr has termed misleading, citing one-off acquisition and restructuring costs.

The uncertainty and legal wrangling associated with this hostile takeover have dampened investor sentiments, putting pressure on Betr shares.

While there wasn’t any announcement from Betr about the acquisition last week, earlier this month, it filed its third supplementary bidder’s statement and now has an unconditional offer for its shareholders.

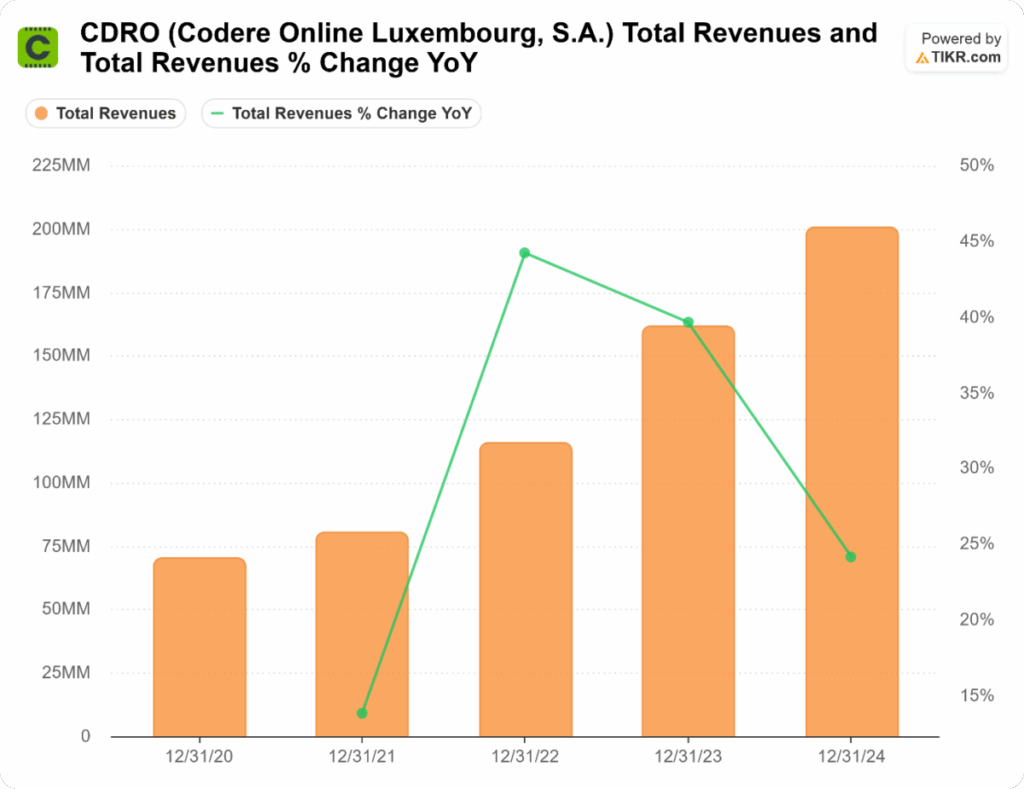

Codere Online (NYSE: CDRO): −10.3%

Codere Online lost 10.3% last week and made it to the list of worst-performing gaming stocks for the third consecutive week.

While the company has demonstrated strong growth, particularly in Latin American markets such as Mexico, it continues to face challenges. These include competitive pressures in Spain, regulatory issues in Colombia, and currency fluctuations.

Its recent financial performance has been reassuring, though, and it posted better-than-expected numbers for the June quarter. The management also maintained its annual revenue guidance of €220-230 million and adjusted EBITDA forecast of €10-15 million despite the headwinds, including adverse currency movements.

Star Entertainment (ASX: SGR): -9.5%

Star Entertainment Group lost 9.5% last week and made it to the list of major losers. Last week’s decline looks linked to Star Entertainment’s removal from the S&P/ASX 300 Index effective today. Just as stocks rise on inclusion in an index, they tend to fall after being booted out, as was the case with SGR last week.

Notably, the stock has been quite volatile over the last month, amid back and forth on its plan to sell its 50% stake in its Queen’s Wharf Brisbane casino to Hong Kong-based partners Chow Tai Fook Enterprises and Far East Consortium. While the talks initially collapsed, the companies reached a binding agreement last month, which would help bring much-needed cash to Star’s coffers.