Gaming stocks had a mixed week, and the Roundhill Sports Betting & iGaming ETF (NYSE: BETZ), which invests in a basket of gaming companies, fell by over 3% even as the S&P 500 Index rose by more than 1%.

Bally’s Corporation and Robinhood were among the major gainers last week. Meanwhile, DraftKings and Melco Resorts underperformed.

Largest Gaming Stock Gainers

Bally’s Corporation (NYSE: BALY) +22.9%

With gains of almost 23%, Bally’s Corporation was the best-performing stock among our coverage of gaming stocks. Despite last week’s gains, the stock is down over 28% for the year and is among the worst-performing gaming stocks this year.

Last week, Bally’s announced an increase in its revolving credit facility, which would help strengthen its balance sheet. It also said that existing and new lenders in its revolving credit facility have consented to the proposed sale and leaseback of its Twin River Lincoln Casino Resort to Gaming and Leisure Properties (NYSE: GLPI). The transaction, which has yet to be approved by the company’s term-loan lenders, would put $735 million in cash, after transaction expenses and taxes, into Bally’s coffers.

Bally’s has a substantial debt pile, with an outstanding balance in its term loan and first lien loan of approximately $2.4 billion, which would decrease to $1.92 billion if the deal with GLPI were to be finalized. Separately, the company is progressing towards the consummation of the €2.7 billion sale transaction of Bally’s International Interactive business to Intralot S.A. It expects the deal to close by the end of this year.

Last week, Bally’s announced plans for Bally’s Las Vegas, where, in collaboration with JLL, it would develop luxury hotel towers totaling 3,000 rooms, a state-of-the-art entertainment venue, and over 500,000 square feet of retail, dining, and entertainment offerings.

Work on the project, which the company’s chairman, Soo Kim, said “represents a once-in-a-generation opportunity to redefine the heart of the Strip,” would commence in the first half of 2026.

Robinhood (NYSE: HOOD) +22.1%

Robinhood, which was added to the S&P 500 Index last month, continued its upward journey and rose an impressive 22.1% last week. The stock has risen fourfold this year, driven by optimism about its predictive business.

Robinhood’s CEO, Vlad Tenev, shared via a social media post that the platform’s prediction markets had surpassed 4 billion event contracts traded all-time, with a significant portion of that volume occurring in the most recent quarter.

Analysts have also been gradually raising HOOD’s target price, and last week, Bank of America, Morgan Stanley, Goldman Sachs, and Needham increased their target prices on the stock. However, Robinhood trades above its mean target price, and many analysts believe the stock is getting ahead of its fundamentals after the breathtaking rally, which has catapulted the company’s market capitalization above $130 billion.

Betr Entertainment Limited (ASX: BBT) +8.1%

With gains of 8.1%, Betr Entertainment was among the biggest gainers last week. The stock has been quite volatile in recent weeks amid its proposed acquisition of PointsBet, where it is engaged in a bidding war with Japanese tech firm MIXI.

PointsBet’s board has recommended that investors opt for MIXI’s offer and has taken actions that Betr has challenged, such as the vesting of performance shares. PointsBet has highlighted Betr’s Entertainment’s negative free cash flows as one of the reasons for rejecting its bid, a move Betr has termed misleading, citing one-off acquisition and restructuring costs.

The uncertainty and legal wrangling associated with this hostile takeover have dampened investor sentiments, and despite last week’s gains, the stock is down nearly 12% for the year.

Largest Gaming Stock Losers

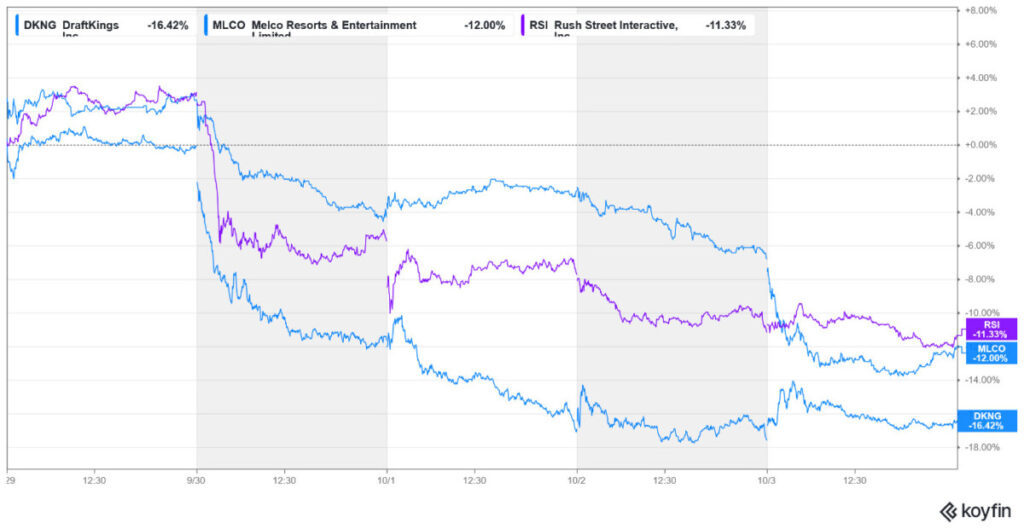

DraftKings (NYSE: DKNG) -16.4%

DraftKings was the biggest loser in our coverage of gaming stocks, losing over 16% last week. The stock has looked weak in recent weeks, shedding over a quarter of its market capitalization in the previous month, and is in the red for the year.

Meanwhile, last week’s decline was more a result of news from prediction market platforms like Kalshi and Robinhood than any company-specific event.

Notably, reports suggest that Kalshi set new all-time trading records over the last weekend, largely driven by sports betting, particularly professional and college football. This surge in activity by a competitor fueled investor concerns that prediction markets are becoming a significant headwind for traditional sports betting operators, such as DraftKings and FanDuel. Kalshi’s launch of sports parlays was the other key trigger for last week’s meltdown in DKNG.

Rising volumes at Robinhood’s prediction business are not helping the cause and only adding to the gloom around DraftKings stock.

Wall Street analysts have also taken note of the competitive pressure, and several brokerages, including Benchmark, Citigroup, JMP Securities, and Oppenheimer, lowered their target prices. Northland Securities went a step further and last week double-downgraded the stock from a “Strong Buy” to a “Strong Sell.”

Melco Resorts and Entertainment (NYSE: MLCO) -12%

Melco Resorts and Entertainment fell 12% last week and made it to the list of top losers. Data released last week showed that while Macau’s September gaming revenue rose 6% to $2.3 billion, it fell short of the 9% increase that analysts had expected. Moreover, while the region’s gaming revenues have recovered from the lows of the COVID-19 pandemic, last month’s revenues were 17% lower than in September 2019.

Unsurprisingly, companies like Wynn Resorts (NYSE: WYNN), which derive a significant portion of their revenues from Macau, also fell last week. Notably, Macau previously reported a strong growth in August revenues, which led to sharp gains in Wynn and Melco. However, even though September is arguably a seasonally weak month for the region, and Super Typhoon Ragasa negatively impacted the activity, the September activity remained tepid and failed to meet the low expectations.

Rush Street Interactive (RSI) -9.5%

Rush Street Interactive was among the other prominent losers last week, falling 9.5%. Regulatory filings showed that key company executives, including Chief Information Officer Einar Roosileht, Chief Financial Officer Kyle Sauers, and Chief Operating Officer Mattias Stetz, sold their holdings. While Sauers’ sales were part of a pre-disclosed trading plan, a flurry of sales from senior executives wasn’t received positively by the market, as insider selling is usually a negative sign for any company.

Meanwhile, RSI’s financial performance has been impressive this year, which has helped its stock rally over 40%. In the June quarter, Rush Street’s revenues rose 22% to $269.2 million, ahead of consensus estimates and a quarterly record for the company.

The bottom line results were also impressive, with Adjusted EBITDA up by 88% YoY, and the EPS landed at $0.11, almost double the $0.06 that analysts were expecting.

The company also revised its 2025 revenue and EBITDA forecasts, with midpoints indicating a year-over-year increase of 16% and 51%, respectively, in these metrics.

Key Gaming Industry Developments

Last week, a consortium comprising Silver Lake, Affinity Partners, and Saudi Arabia’s Public Investment Fund (PIF) announced the acquisition of gaming giant Electronic Arts (EA) in a massive $55 billion deal, marking a significant investment by the Saudi sovereign wealth fund in the global gaming space.

On the regulatory front, the Swedish government is proposing a complete ban on licensed operators allowing or contributing to gambling financed with credit to prevent gambling-related indebtedness.

Notably, the global regulatory landscape regarding gaming and gambling has been evolving, and while some countries have taken a more constructive approach, others, such as India, have opted for an outright ban on online real-money games.

Meanwhile, gaming remains a key contributor to government coffers and a key employment generator. Hard-pressed by growing deficits, several governments have increased taxes on gaming.

Last week, British Chancellor Rachel Reeves hinted that a gambling tax rise is being considered. The long-rumored move, which has political support, is facing opposition from gaming companies who argue it would only push more people into the illegal market.