South Korean casino stocks are “continuing to soar,” domestic media outlets say, as room occupancy rates in some hotel-casinos rise above 90%.

Per a report from the South Korean media outlet News1, the share prices of the country’s three largest operators of foreign passport holder-only casinos “all recorded their highest growth rates since the start of the coronavirus pandemic.”

Large-scale “net buying by overseas investors and institutions” is driving up market demand, the outlet wrote, quoting experts from Hanwha Investment & Securities.

Hanhwa added that “cumulative net purchases by foreigners and institutions” of stocks in these three companies so far this year amount to “approximately 530 billion won ($365.3 million).”

South Korean Casino Stocks: Growth Outpacing KOSPI Performance

Rising tourist numbers are also increasing foot traffic at casinos nationwide. The government has looked to boost tourism incomes in recent months by temporarily waiving visa fees for Chinese group tourists.

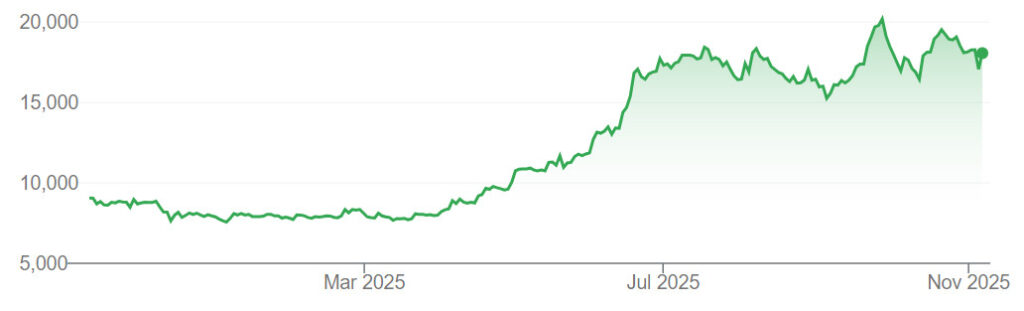

Lotte Tour Development, the operator of the Jeju Dream Tower casino-resort in Jeju Province, has seen its share prices rise by almost 150% since the start of this year.

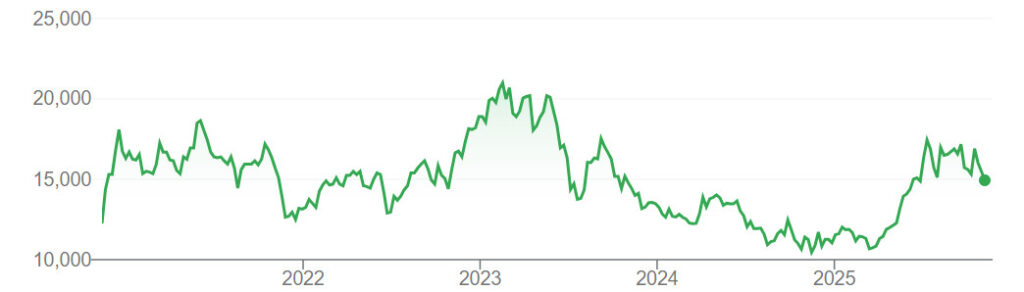

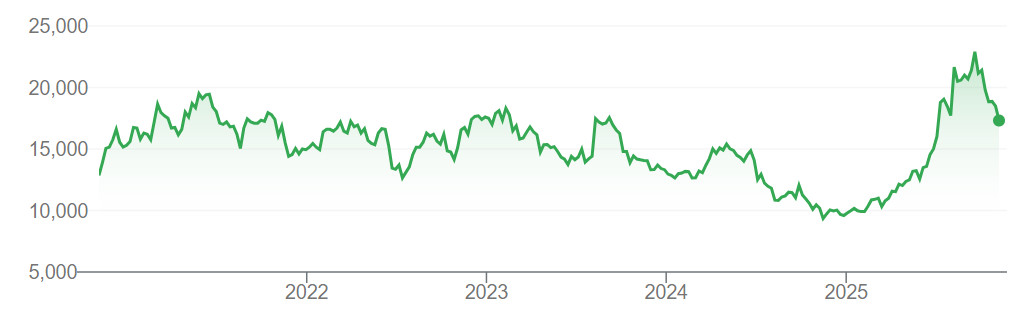

Paradise, the owner of Paradise City in Incheon, has seen a 100% rise. And Grand Korea Leisure (GKL), which runs the Seven Luck casino brand, has seen a 49% increase.

This rate of growth has eclipsed even that of the Korea Exchange’s KOSPI index of leading shares, analysts added.

‘Massive Liquidity Surge’

Park Soo-young, a researcher at Hanwha, said: “The massive liquidity surge released during the pandemic has flowed into leisure and gaming funds. […] This trend is likely to continue until 2026.”

All three operators have seen a sharp uptick in VIP sales to Japanese and Chinese customers. Financial analysts told the media outlet that these customers are now spending up to 30% more than in previous years.

Park added that a post-pandemic rise in asset values was now “leading to increased casino spending.”

The South Korean newspaper Maeil Kyungjae reported that some operators are looking to expand their offerings beyond casinos.

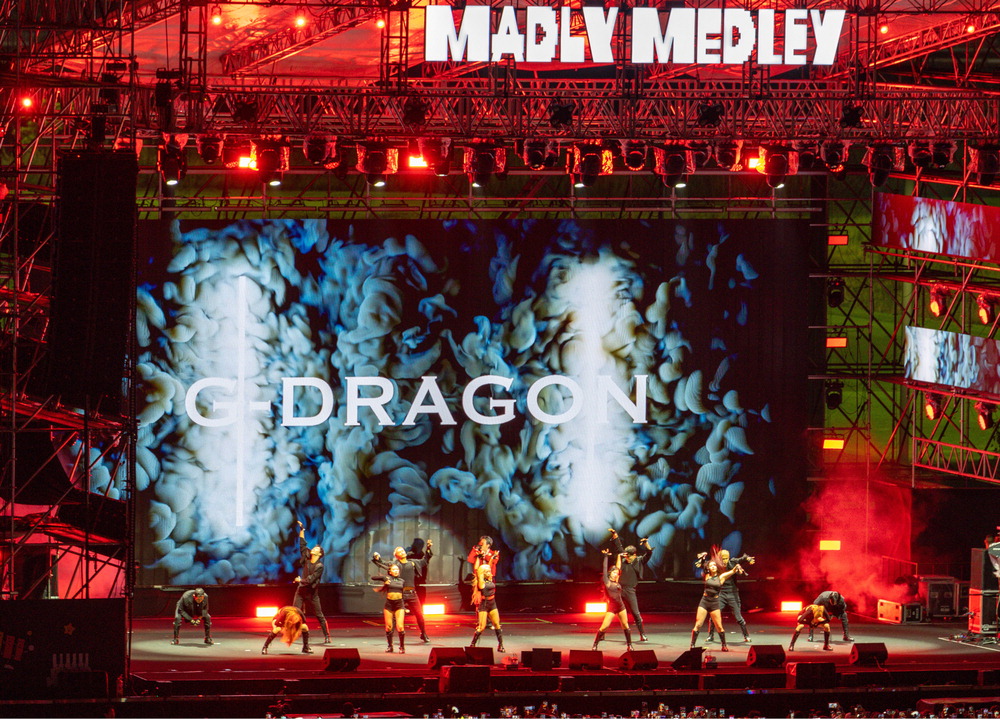

In July, the K-pop star G-Dragon performed his “first-ever solo festival performance” at Paradise City, attracting over 60,000 fans over two days.

The outlet wrote that a “whopping 12,000 of these were foreign tourists,” driving up Paradise City’s room occupancy rate.

Paradise City officials said they estimated the event “generated an economic impact of nearly 40 billion won ($27.6 million).”

Nevertheless, some industry insiders have criticized foreign passport-holders-only casino models. Critics argue that focusing exclusively on tourists cannot lead to sustainable growth.

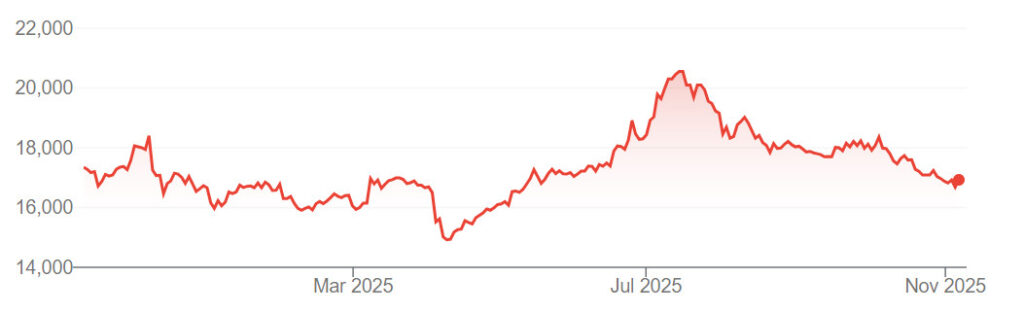

However, share prices in Kangwon Land, the operator of the only South Korean casino that admits domestic visitors, have fallen in recent months after hitting a peak on July 11.

Casino stocks have enjoyed high growth rates across Asia in 2025, with Macao operators also recording a rise in visitor numbers and sales.

But some United States-based players saw a mixed end to the month in October, with the likes of Super Group seeing falls ahead of Q3 earnings calls.

In August, Jeju Dream Tower overtook Paradise City to become the country’s highest-earning casino with a foreign passport-holder-only admissions policy.