The Roundhill Sports Betting & iGaming ETF (NYSE: BETZ), which invests in a basket of gaming companies, rose 1.28% last week and underperformed the S&P 500 Index, which hit fresh records in the holiday-shortened week. The ETFs’ year-to-date returns are slightly below those of the broad-based index, and although they had been outperforming the markets by a significant margin for some time this year, gaming stocks lost momentum in October and November.

The Star Entertainment Group and Light and Wonder were among the major gainers last week. Meanwhile, Skillz and the Rank Group were among the major losers.

Biggest Gainers

The Star Entertainment Group (ASX: SGR) +13.04%

With gains of over 13% last week, the Star Entertainment Group was the biggest gainer in our coverage of gaming stocks. The stock had added a quarter to its market capitalization in the preceding week as well. However, despite these gains, the stock is still down nearly 32% for the year.

Meanwhile, there was no major company-specific news last week, and the stock appears to have continued its uptrend from the previous week, when it announced a major shakeup of its C-suite.

As part of the management reshuffle, Steve McCann, who was brought in to lead the company through its financial crisis and remediation plan, stepped down as CEO. Peter Hodgson and Toni Thornton, two of the company’s non-executive directors, also resigned from the board.

Star appointed Bruce Mathieson Jnr (a member of the billionaire Mathieson family, one of Star’s largest investors) as the new CEO. Concurrently, Soo Kim, chairman of the US-based Bally’s Corporation, took over as the new Chairman of the Board.

Notably, the leadership changes come a month after Star secured the necessary regulatory approvals from the New South Wales Independent Casino Commission and Queensland’s Office of Liquor and Gaming Regulation, which allows the conversion of a $300 million Australian dollar investment from Bally’s Corporation and Investment Holdings Pty Ltd into equity.

Light & Wonder Inc. (ASX: LNW) +9.01%

With gains of 9%, Light & Wonder was among the major gainers last week. Thanks to these gains, LNW, which delisted from the US markets in favor of its sole primary listing in Australia, is now up a respectable 15% for the year.

LNW has been aggressively buying back shares, which seems to have led to the recent gains. Apart from the buyback announcements disclosed in regulatory filings, there wasn’t any other major financial update from the company last week.

Century Casinos (NYSE: CNTY) +7.69%

Century Casinos, which had a terrible year and lost over half of its market cap in the year, was among the major gainers last week and rose nearly 7.7%. Last week’s rise appears to be a technical rebound rather than a sign of any fundamental change for the company.

The company’s recent financial performance has been dismal, and it missed on most key metrics in Q3. For instance, its revenues came in at $153.7 million, which was significantly below the $163.4 million that analysts had modeled. Its net loss rose 30% year-over-year to $10.5 million, which was also higher than the analysts’ expectations.

CNTY is a loss-making microcap company with a market capitalization below $50 million, characterized by low trading volume and a beta of over 2x, which makes it susceptible to significant price swings and is therefore a high-risk and speculative investment.

Top Losers

Skillz (NYSE: SKLZ) – 9.5%

Skillz fell 9.5% last week and was the top loser in our coverage of gaming stocks, a dubious distinction it also held in the preceding week. The company has filed its 2024 annual report and quarterly filings for the first nine months of 2025 with the SEC after a long delay, which was a major relief for investors, as the inability to do so could have led to the stock’s delisting.

Earlier this month, Skillz announced the departure of its CFO, Gaetano Franceschi, and the appointment of Michael Darwal as his successor. While Skillz said that Franceschi’s departure was “without cause” and was not related to any disagreements regarding financial reporting, operating results, or accounting practices, the sudden removal of a CFO is seldom received positively by the markets.

It was a roller-coaster ride for Skillz, a former meme stock darling, in 2025. The stock hit its 2025 high of $9.11 in mid-August amid the rally in meme stocks, but has since lost over 46% from those levels.

Given that Skillz is down significantly from its 52-week high, it is a prime candidate for tax-loss harvesting. Investors often sell their “losing” positions in the final weeks of December to offset capital gains elsewhere, which creates additional downward pressure on the share price. Last week’s losses may be attributed to tax loss harvesting, coupled with lingering concerns about the financial health of the loss-making company.

The Rank Group (LSE: RNK) -4.36%

The Rank Group fell by over 4% last week, which narrowed its year-to-date gains to 17.2%. Last week’s losses were attributable to the payment fraud in its Spanish businesses, Enracha and Yo. The company estimates the financial cost of the incident at approximately €7.1 million (£5.9 million).

Beyond the immediate cash loss, the incident raised serious questions regarding the company’s internal controls and risk management protocols within its international divisions. The company was reeling from the lingering effects of the UK’s gambling tax hike, announced as part of the Autumn Budget, and just when things were settling down on that front, it was hit by a payment fraud.

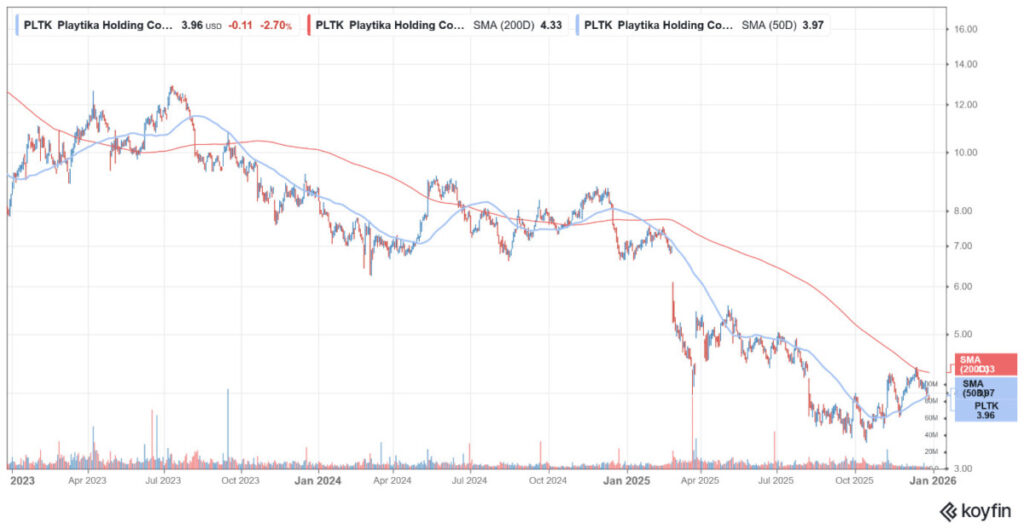

Playtika Holdings (NYSE: PLTK) – 3.4%

Playtika Holdings fell 3.4% last week and is now down nearly 43% for the year. Among other concerns, markets are worried about the declining revenue of Playtika’s mature social casino games, particularly Slotomania, which is one of the company’s largest revenue generators.

Last week, the stock went ex-dividend, which invariably leads to a drop in stock price mimicking the dividend. Moreover, there was also likely tax loss harvesting in the stock, which is down sharply this year.

Major Gaming Industry Developments

Prediction markets continued to attract new players, and FanDuel launched its FanDuel Predicts platform last week. Cryptocurrency exchange Coinbase also agreed to acquire The Clearing Company, a prediction markets platform, as it doubles down on its prediction markets business.

Elsewhere, lawmakers in Japan reiterated their firm opposition to legalizing sports betting, citing concerns over match-fixing and athlete protection, which could potentially stall a multi-billion-dollar market opportunity.