Red Rock Resorts, the parent company of South Nevada gaming organisation Station Casinos, has neared the completion of its Palms Casino Resort redevelopment project, as net income for the year’s first quarter took a stark downward turn.

Coming in at $20.3m for the period, representing a 75.3 per cent decline year-on-year from $82.1m, the casino owner stated that “the decrease in net income was primarily due to a decrease in the fair value of derivative instruments, an increase in write-downs and other charges, and a prior year gain associated with the extinguishment of a tax receivable liability”.

It was operations within Las Vegas that were once again a big factor in driving revenue and adjusted EBITDA forward, with the former increasing 6.2 per cent to $447m (2018: $421m), while the latter reached $145.1m, a slight 3.6 per cent boost to 2018’s $140.1m.

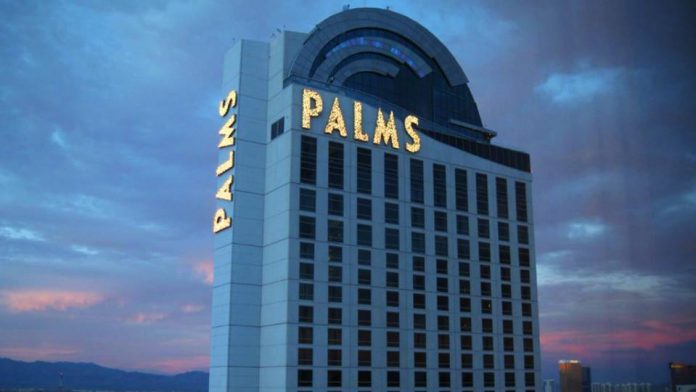

In its first quarter financial report an update of its current construction enterprise was also provided, as Red Rock explained: “The Palms redevelopment project remains on schedule and the budget remains unchanged. With the exception of the new wellness spa and salon (which is expected to be complete by the end of the second quarter of 2019), phase two of the project is now complete.

“In addition, with the exception of Michelin-starred dim sum restaurant Tim Ho Wan (which is expected to be complete by the end of the third quarter of 2019), phase three of the project is now also complete. As of March 31, 2019, the company has incurred approximately $587m in costs against the $690m project.”

Briefly looking at the Red Rock figures closer, Las Vegas operations saw a revenue rise of 6.9 per cent to $422.4m (2018: $395.2m), with adjusted EBITDA reaching $130.5 for Q1, a 3.7 per cent jump from $125.9m.

Native American operations saw decreasing fortunes across both revenue, down 6.5 per cent to $22.9m (2018L $24.5m), and adjusted EBITDA, which dropped 2.8 per cent to $21.5m (2018: $22.1m), “due to the expiration of the Gun Lake management agreement in February of 2018, partially offset by increased management fees generated under the Graton Resort management agreement”.