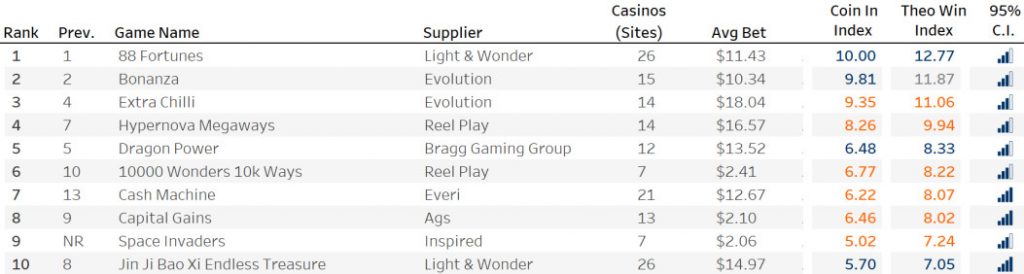

Light & Wonder’s 88 Fortunes has maintained its place at the top of the slots rankings in April’s Eilers-Fantini Online Game Performance Report, as International Game Technology topples Design Works Gaming in the overall charts.

This latter point saw Blackjack relegate DWG’s Break The Bounty to second, with L&W’s 88 Fortunes complementing its slots lead with a third placed finish overall.

An array of new entrants include DWG’s Piggy Payouts Bank Buster and Ainsworth’s Rise of The Dragon, with Space Invaders by Inspired and the Fa Fa Babies slot by Evolution’s Red Tiger also becoming fresh faces in 17th and 25th, respectively.

As this concluding pair follow this up with placings at 12th and 18th in the slots charts, Evolution’s Big Time Gaming sits directly behind the aforementioned leader in second and third with Bonanza and Extra Chilli.

On a gross gaming revenue breakdown of slots suppliers, Evolution does indeed lead the way with a 30.2 per cent total ahead of IGT (24.1 per cent) and L&W (17.3 per cent).

Rick Eckert, managing director of slot performance and analytics at Eilers & Krejcik Gaming, commented: “Today we published the Eilers-Fantini Online Game Performance Report – April ’22. This month the slot segment was led by Light & Wonder 88 Fortunes, Evolution Bonanza & Extra Chilli, ReelPlay Hypernova Megaways, and Bragg Gaming Dragon Power

“IGT continued to lead table games and video poker with Blackjack and Game King Poker, while Inspired Gaming Group led virtual sports, Design Works Gaming had the top performing instant win game with Break the Bounty, Pixiu Gaming had the top ranking bingo/keno game with Lucky 8 Keno.”

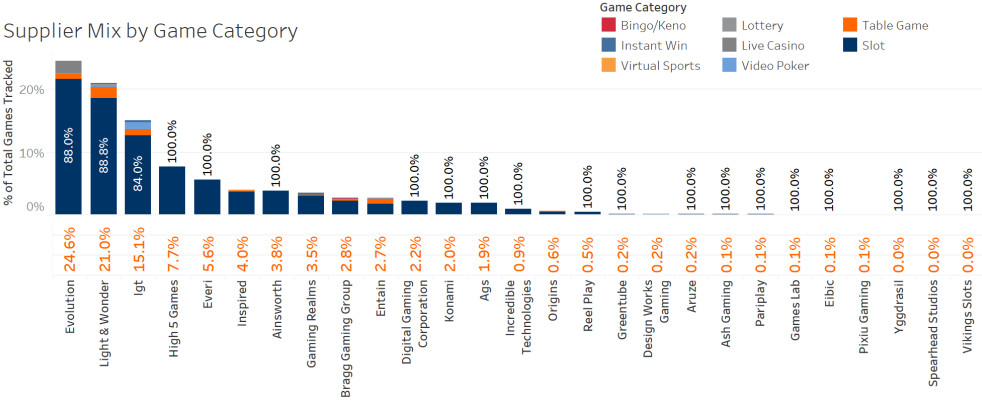

An enhanced position of dominance has also been evidenced by slots in this latest report, after accounting for 90.1 per cent of all games tracked, up from 89.9 per cent and 88 per cent during March and February.

This, once again, comes out ahead of table games’ 4.9 per cent (March: 5.1 per cent), live casino with 1.9 per cent (March: two per cent), video poker which remains consistent once more at 1.7 per cent, instant win’s 0.8 per cent (March: 0.7 per cent) virtual sports’ 0.2 per cent (March: 0.2 per cent), lottery with 0.3 per cent (March: 0.3 per cent), and bingo/keno which rises slightly to 0.2 per cent.

Evolution gains a further top spot by retaining its place at the summit of the ‘Supplier Mix by Game Category’ breakdown after accounting for 24.6 per cent (March: 22.4 per cent) of all games tracked, 88 per cent of which were slots.

The rebranded L&W and IGT again followed in second and third with similar figures month-on-month, accounting for 21 per cent and 15.1 per cent of all games with 88 per cent and 84 per cent being slots. High 5, Everi, Inspired and Ainsworth followed.

“We continue to see new suppliers emerge into the North American Market now tracking 27 unique suppliers across the 28 casino sites in the US,” Eckert continued.

“While Evolution, Light & Wonder, and IGT continue to dominate the games tracked collectively accounting for over 60 per cent of the games, we have recently witnessed emerging suppliers eat into market share and produce top performing games.

“Last month we highlighted the instant win games From Design Works Gaming which continue to produce solid revenues for operators, but this month we get highlights from Pixiu Gaming with their Lucky 8 Keno ranking atop the Bingo/Keno segment, Inspired’s Space Invaders entering our database in the top 10 ranking slots themes, and Ainsworth’s Rise of The Dragon narrowly missing the top 10 slots after coming in at number 12 in our formal rankings.

“As our database continues to grow and expand we will specifically segment NEW Games in our monthly report from games that have been in the market longer.”

Mobile maintains its frontrunning status with the highest percentage of theo win generated at 63.6 per cent (February: 62.2 per cent), leading the way in slots, table games, live casino, lottery, instant win, virtual sports, and bingo/keno.

Desktop is reported as producing a theo win of 33 per cent (February: 34.1 per cent) and forges ahead in the video poker category, the sole vertical not dominated by mobile during the month. Tablet lags behind with a theo win of 3.5 per cent (March: 3.7 per cent).

The Eilers-Fantini report collects monthly game performance data directly from online operators to track how games perform in the region’s igaming ecosystem, with an ambition of growing the database similarly to that of its land-based game performance index.

This latest analysis examines data from 28 online casino sites, across Connecticut, New Jersey, Pennsylvania, Michigan, and West Virginia, tracking 29,568 games to represent 57 per cent of the market in terms of gross gaming revenue.

If interested in learning more, subscribing, or participating in the Eilers-Fantini Online Game Performance Database reach out to Rick Eckert at [email protected].