Aristocrat and Design Works Gaming have stood tall in the land-based and online North American slots charts through the second quarter, reports Eilers and Krejcik Gaming and Fantini Research in a Q2 breakdown.

The report, which tracks 29 online casino sites that cover 32,968 games to represent 58.5 per cent of the market across Connecticut, New Jersey, Pennsylvania, Michigan, and West Virginia, features the former asserting much dominance over the land-based space.

Aristocrat sees its Dragon Link – Golden Century and Dragon Link – Happy and Prosperous titles sandwich Light & Wonder’s Blazing 777’s Triple Double Jackpot Wild at the top of the charts of games that are active on a retail basis but not online.

However, despite boasting 15 of the top 25 ranks, which also includes eight Dragon Link offerings, which incorporate many attributes made popular by Lightning Link, the group is yet to hit the real money online casino market in the US.

With attention switching solely to that of igaming, it is Molten Hot 7’s by DWG that beats off the challenge of Evolution’s Big Time Gaming which closes in second and third with Bonanza and Extra Chilli.

“Themes like Zeus 2 (L&W) have seen success online while the same theme is no longer tracked in the 350,000 slots included in the land-based market,” noted Rick Eckert, managing director of slot performance and analytics at Eilers & Krejcik Gaming.

“Other themes like Bonanza, Hypernova Megaways (Reel Play), and Lucky Larrys Lobstermania Slingo (Gaming Realms) have been proven performers online without a land-based presence.”

L&W claims the prize for most titles in the top 25 rankings with six, ahead of Evolution that narrowly misses out with five and DWG and IGT with three apiece.

Top Indexing Slots that are currently active in both aforementioned disciplines include IGT’s Wheel of Fortune at the summit, ahead of L&W’s Dancing Drums Explosion (second) and 88 Fortunes (fourth), Cash Machine by Everi (third) and Rakin Bacon by AGS which make up the top five.

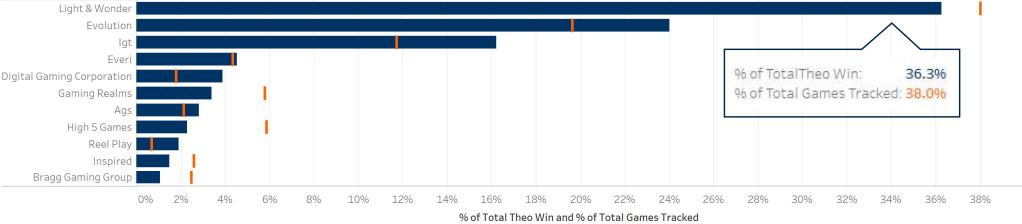

The dashboard also uses a fair share analysis in its inspection, which compares the percentage of total games, or positions, against that of total theoretical revenue generated.

“A positive fair share is when the percent of total theoretical revenue generated exceeds the percent of total games, while a negative fair share is the inverse,” it is stated.

Slots and instant win are reported as coming out as negative due to boasting total games tracked of 89.6 per cent (theo win 79.5 per cent) and one per cent (theo win 0.4 per cent), respectively.

Positive readings are recorded by table games (theo 11.4 per cent, games 6.2 per cent), live casino (theo 7.3 per cent, games 1.6 per cent), and video poker (theo 1.4 per cent, games 1.2 per cent).

Furthermore, with the number of online casino brands in the US increasing to 41 during 2022 from the past year’s 39, it’s L&W which accounts for the most games tracked at 38 per cent however win comes in at 36.3 per cent.

This is ahead of Evolution (theo 24 per cent, games 19.6 per cent), IGT (theo win 16.2 per cent, games 11 per cent), Everi (theo win 4.5 per cent, games 4.3 per cent) and Digital Gaming Corporation (theo win 3.9 per cent, games 1.7 per cent) in making up the top five.

If interested in learning more, subscribing, or participating in the Eilers-Fantini Online Game Performance Database reach out to Rick Eckert at [email protected].