With no fresh launches on the slate for the current year, online casino content suppliers have an opportunity to expand coverage across legalised US markets, suggested Rick Eckert, Managing director of Slot Performance and Analytics at Eilers & Krejcik Gaming.

Speaking upon publication of the latest Eilers-Fantini Online Game Performance Report, Eckert pointed to consolidation currently taking place in Ontario in elaborating on the potential opportunity presented by a lack of further legalisation.

Looking at if a lack of progression regarding legalised igaming across further states is potentially holding back the US’ ecosystem, he commented: “It does seem like the hot topic last year from operators and suppliers in the US market was expansion and coverage into Ontario, but speaking with those engaged parties recently there is consolidation taking place on each side.

“With no planned states launching online casinos in 2023, suppliers have more opportunity to successfully expand their coverage into current markets that are more difficult on the approval process, like Pennsylvania.”

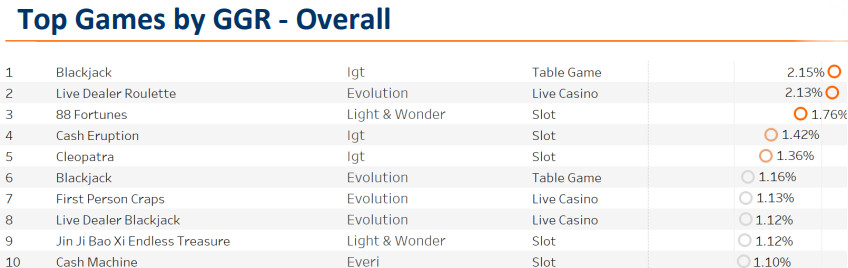

Despite the group’s latest assessment, covering the month of March, featuring a slew of fresh igaming entrants, on an overall GGR basis it is very much a case of familiarity.

IGT’s Blackjack continues to lead the way, albeit with a drop in GGR percentage to 2.15 (February: 2.63 per cent), with Cash Eruption (1.41 per cent), Cleopatra (1.36 per cent) and Fortune Coin (0.94 per cent) also maintaining positions in the top 25.

However, the Evolution Group’s Live Dealer Roulette significantly closed the gap on the table game, closing the month with a percentage of 2.13 (February: 1.98 per cent). The company also counted five further live casino titles, one table game and four slots in the rankings.

However, the premier online slot on a GGR basis through the month remains Light & Wonder’s 88 Fortunes with 1.76 per cent (February: 1.61 per cent), beating off competition from 16 similar such entrants in the top 25.

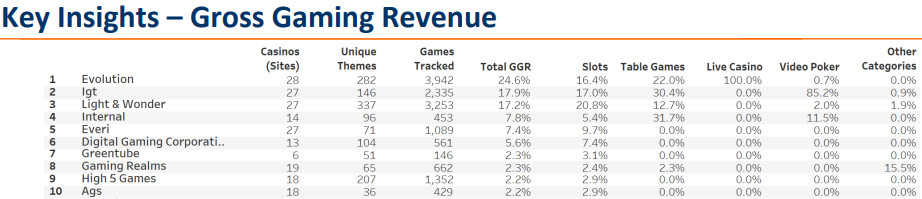

On an overall basis, Evolution leads the way overall with a total GGR of 24.6 per cent (16.4 per cent on a slots basis), which is down from the previous month’s 26.2 per cent.

IGT was next in line with an overall percentage of 17.9 (February: 20.8 per cent), of which 17 per cent was slots, while L&W rounded off the top three once more with 17.2 per cent (February: 18.7 per cent) and a slots score of 20.8 per cent.

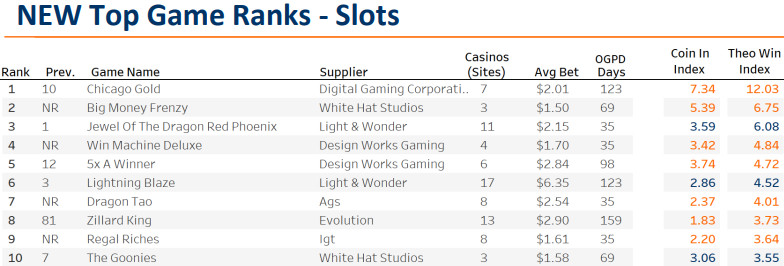

On a new games basis, for the second consecutive month it is a case of family on both the overall and slots rankings when taking a look at the five titles that sit at the summit.

Regarding the latter, Digital Gaming Corporation’s Chicago Gold takes a leap from 15th to first, ahead of the highest fresh entrant of Big Money Frenzy by White Hat Studios.

L&W’s Jewel of the Dragon Red Phoenix, which soared to the top in February, sees its wings clipped to finish third, ahead of the Win Machine Deluxe and 5x A Winner games of Design Works Gaming.

With March’s report featuring a number of previously unranked titles, Eckert looked at if this is evidence that competition is intensifying. He said: “In 2022 we averaged one new supplier tracked per month in the OGPD.

“This resulted in the top three suppliers by percentage GGR (Evolution, LNW, and IGT) losing share in the past 12 months from 62 per cent to 58.9 per cent.

“In addition to new suppliers being tracked seeing success like White Hat Studios, Play N Go, and a recent newcomer with Skilzzgaming, what may be considered mid-level suppliers (Everi, Digital Gaming Corporation, and Greentube) steadily added more operators coverage throughout the trailing 12 months resulting in gained GGR share.”

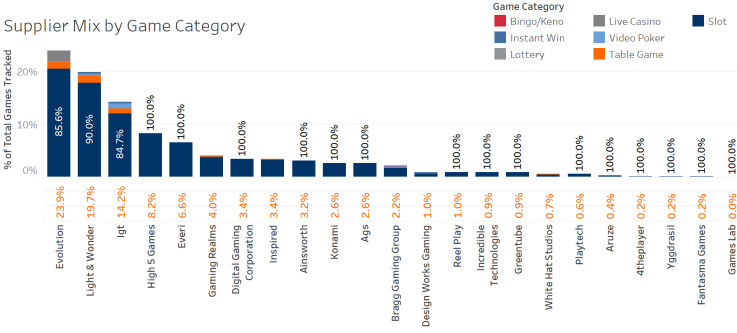

On the ‘supplier mix by game category’ classification, it is Evolution that maintains its place at the summit, despite detailing a drop month-on-month. Through March the group occupied 23.9 per cent (February: 26.2 per cent) of the space, of which 85.6 per cent (February: 85.4 per cent) are online slots.

L&W leapfrogged into second with 19.7 per cent (February: 18.8 per cent), of which 90 per cent (February: 90.2 per cent) were slots. IGT slipped into third with a portfolio made up of 84.7 per cent slots to claim 14.2 per cent (February: 18.8 per cent) of the total ecosystem.

Slots remained the dominant segment when looking at the total games tracked with a total percentage of 90.6, ahead of table games’ 4.5 per cent.

Live casino was next in line with 2 per cent, ahead of video poker’s 1.4 per cent, the 1.1 per cent gained by instant win and 0.2 per cent shared by lottery and bingo/keno.

Mobile maintains its frontrunning status with the highest percentage of theo win generated at 65.5 per cent (February: 64.3 per cent) and leads across most segments, with desktop, via a theo win of 32.2 per cent (February: 33.5 per cent), soaring ahead in video poker and virtual sports. Tablet continues to bring up the rear via a slight drop to 2.2 per cent.

This latest analysis examines data from Michigan, West Virginia, Pennsylvania, New Jersey and Connecticut across 30 online casino sites, tracking 42,270 games to represent 59 per cent of the market.

If interested in learning more, subscribing, or participating in the Eilers-Fantini Online Game Performance Database reach out to Rick Eckert at [email protected].