Macao casino stocks are continuing to enjoy growth on securities markets in Hong Kong, with foot traffic and profits on the rise.

Last week saw strong gains from operators such as Sands China, a majority-owned Las Vegas Sands Corporation listed on the Hong Kong Stock Exchange.

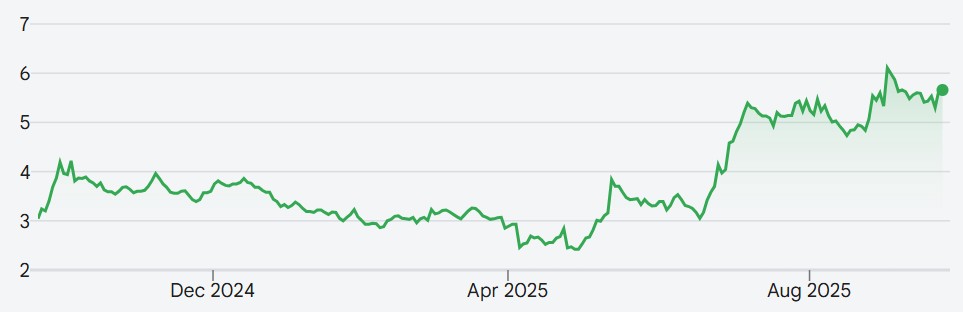

The firm operates the Sands Macao casino and has seen its share prices rise by over 43% over the past 12 months.

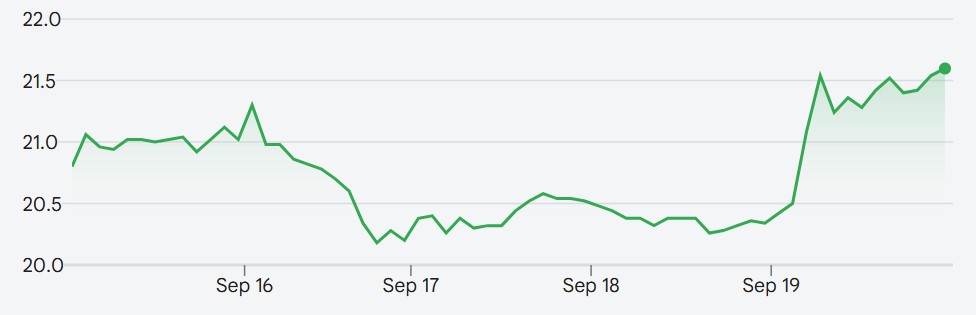

Share prices in Galaxy Entertainment Group, the operator of the Galaxy Macao, the StarWorld Hotel, and the Broadway Macao, have climbed by almost 6% in the past month.

Macao Casino Stocks: An Upward Trajectory?

Other notable climbers include the City of Dreams Macao integrated resort operator Melco International Development. Melco’s share prices have grown by almost 73% in the year to date.

Super Golden Week Windfall Incoming?

Wynn Macao, which operates several hotels and casinos in the region, has also seen share prices rise by almost 26% in the past six months.

Other operators have seen similar rises over the past weeks and months, with the likes of MGM China experiencing a 7.34% increase in the last four weeks.

Japan’s Nicovideo noted that the strong showing may have been spurred by a September 17 announcement from Macao authorities. Financial chiefs stated that the Chinese special administrative region’s casinos reported a 24.7% year-over-year increase in pre-tax profits for FY2024.

This, the outlet explained, marks the second consecutive year of positive growth, following a strong showing last year. August casino sales also hit their highest level since the outbreak of the COVID-19 pandemic.

The media outlet Futubull reported that the banking giant Barclays last week adjusted its Macao gaming revenue forecast for this year upward by 6% to $31 billion.

The bank thinks that the sector is benefiting from “strong growth momentum, robust visitor numbers, and an improving macroeconomic environment.”

Operators in Macao are hoping to reap the benefits of a bumper “Super Golden Week” holiday this year.

In China, this term refers to the extended period of public holidays in years when China’s National Day (October 1, the anniversary of the founding of the People’s Republic of China) overlaps with the Mid-Autumn Festival.

This year, the holiday period will run from October 1 to October 8.

While Barclays has predicted that growth will cool in 2026, the bank thinks that share prices should continue to rise this calendar year.

VIP Spending Spree

High-spending customers may spearhead the upward growth, with VIP room revenue projected to grow by 12.9% in the second quarter of 2025.

Observers say that some tourists are choosing Macao over Southeast Asian destinations, such as the Philippines and Cambodia, due to “safety concerns.”

Casino operators throughout Asia are enjoying a successful 2025 so far. Share prices in casino firms are also rising in South Korea, where revenues continue to increase.

And casinos in Russia’s Far East gambling zones are also seeing footfall and profits rise. Plans are now afoot to build a new Chinese investment-backed casino in Primorsky Krai.