While the S&P 500 Index managed to close flat last week, the Roundhill Sports Betting & iGaming ETF (NYSE: BETZ), which invests in a basket of gaming companies, lost 1.2%. It was the sixth consecutive week when the ETF underperformed the broader markets.

While the longest US government shutdown ended last week, economic concerns persist, putting pressure on consumer-facing companies, including those in the gaming sector.

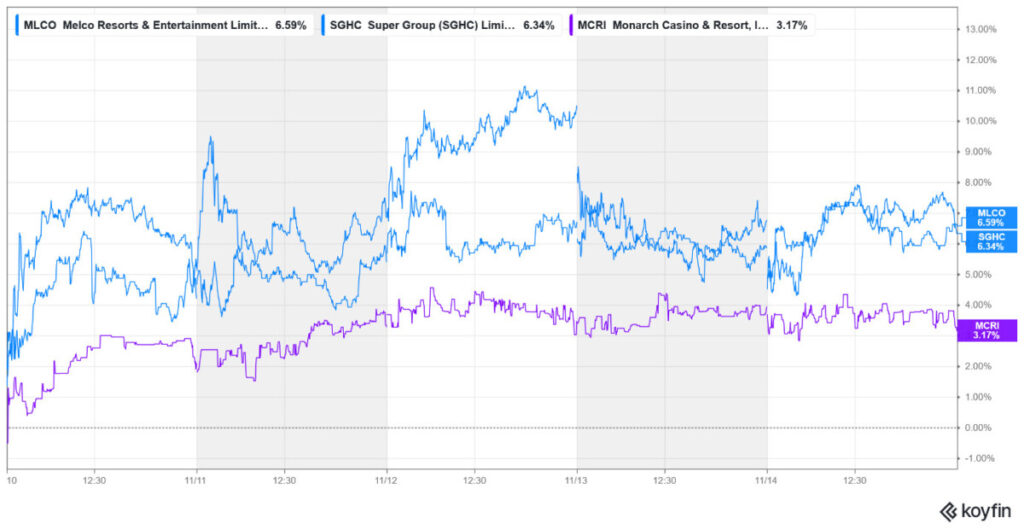

Melco Resort and Entertainment and Super Group were among the major gainers last week. Meanwhile, Gambling.com and Century Casinos underperformed, with both experiencing double-digit declines last week.

Largest Gaming Stock Gainers

Melco Resorts and Entertainment (NYSE: MLCO) +6.59%

In an otherwise dismal week for gaming stocks, with gains of nearly 6.6%, Melco Resorts and Entertainment was the biggest gainer in our coverage of gaming stocks. While there wasn’t any major market-moving news last week, the company had posted better-than-expected results for the September quarter in the preceding week.

Its revenues rose 11% year-over-year to $1.31 billion, which was slightly higher than the consensus estimate of $1.28 billion. The company’s EPS rose more than threefold to 19 cents, which easily beat estimates. Following the results, which were driven by both gaming and non-gaming operations, JPMorgan raised the stock’s target price from $10.5 to $11 last week while maintaining its overweight rating.

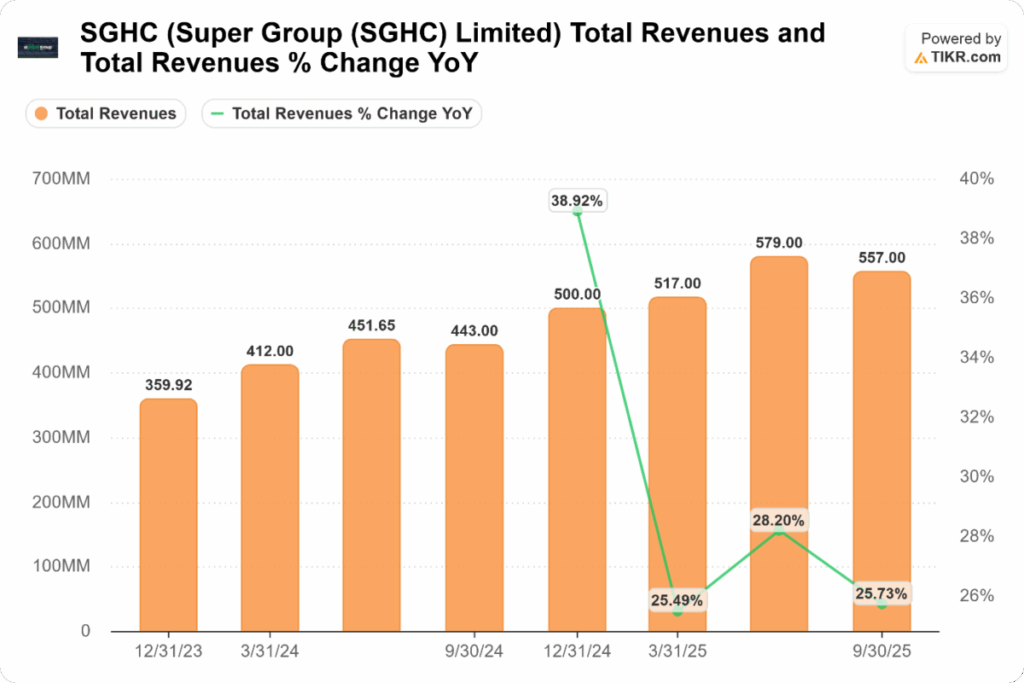

Super Group Limited (NYSE: SGHC) + 6.34%

Super Group shares rose over 6% last week and have nearly doubled this year. The company had released its Q3 earnings the preceding week and reported a 26% year-over-year increase in revenues, led by strength in international markets. Its adjusted EBITDA rose 65% to $152.1 million during the quarter, which was ahead of Street estimates.

Following the stellar Q3 performance, SGHC raised its full-year revenue guidance to a range of $2.17 billion to $2.27 billion, up from the previous guidance of $2.125 billion to $2.20 billion. Similarly, it raised the annual EBITDA guidance to $555 million and $565 million.

Monarch Casinos (NYSE: MCRI) + 3.17%

Monarch Casinos was among the other major gainers, rising over 3% last week. Earlier this month, the company introduced a promotional offer through its Bet Monarch app in Colorado, marking a renewed effort to expand its digital gaming footprint and boost customer engagement during the busy NFL season. Previously, it reported record results for the third quarter, delivering all-time high net revenues and net profits.

Largest Gaming Stock Losers

Gambling Group (NYSE: GAMB) -21.2%

With losses of 21.2%, Gambling Group was the biggest loser in our coverage of gaming stocks. Last week’s decline was attributable to the company’s Q3 earnings release, where it not only missed on revenues, which came in at $38.98 million versus the consensus estimate of $41.2 million, but also lowered its full-year revenue guidance to $165 million from the previous range of $171 million to $175 million.

In its release, GAMB said that the guidance cut “reflects the continued headwind of poor organic search dynamics which affected the marketing business for all of Q3 and, while recently somewhat recovering, persists in Q4.” It added, “The Company’s prior full-year guidance included an expectation that more progress would have been made against spam websites than has been seen to date. The revised guidance also includes approximately $1 million in higher cost of sales than previously anticipated related to the successful acceleration of the traffic diversification strategy.”

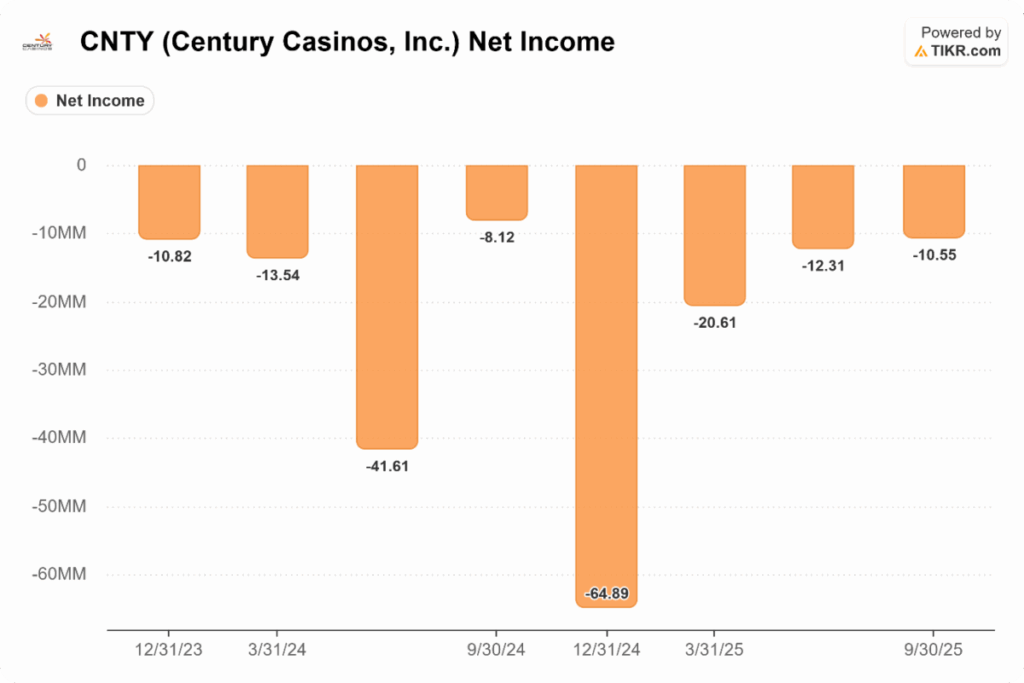

Century Casinos (NYSE: CNTY) -11.6%

With a loss of nearly 14%, Century Casinos was among the major losers in our coverage of gaming stocks last week. The company released its Q3 earnings last week, missing on most key metrics. For instance, its revenues came in at $153.72 million, which was well short of the $163.45 million that analysts were modeling. Its net loss rose 30% year-over-year to $10.5 million, which was also higher than the analysts’ expectations.

Following the earnings release, Stifel lowered its target price from $4 to $3 while maintaining its buy rating.

CNTY has been quite volatile this year, and while it has risen from the 52-week low of $1.30 it hit amid the April sell-off, it is still down nearly 53% for the year, often finding its way into the top weekly losers. CNTY is a loss-making microcap company with a market capitalization below $50 million, with little trading volume and a beta of over 2x, which makes it susceptible to wild price swings and is therefore a risky bet.

Betr Entertainment (ASX: BBT) -8.73%

Betr Entertainment stock fell by over 8.7%, which appears to be a profit-taking exercise following the stellar gains of the previous week. Notably, in the week ending November 7, Betr released its Quarterly Activities Report and Appendix 4C for fiscal Q1 2026, which showed turnover rising 27% year-over-year to Australian dollars (AUD) 363 million. The company’s net win margin expanded to 10.5% which helped push net wins to AUD 38 million – 36% higher than the corresponding quarter last year.

Betr Entertainment made it to the list of major gainers that week, and it looks likely that some investors booked profits from the stock last week.

Major Gaming Industry Developments

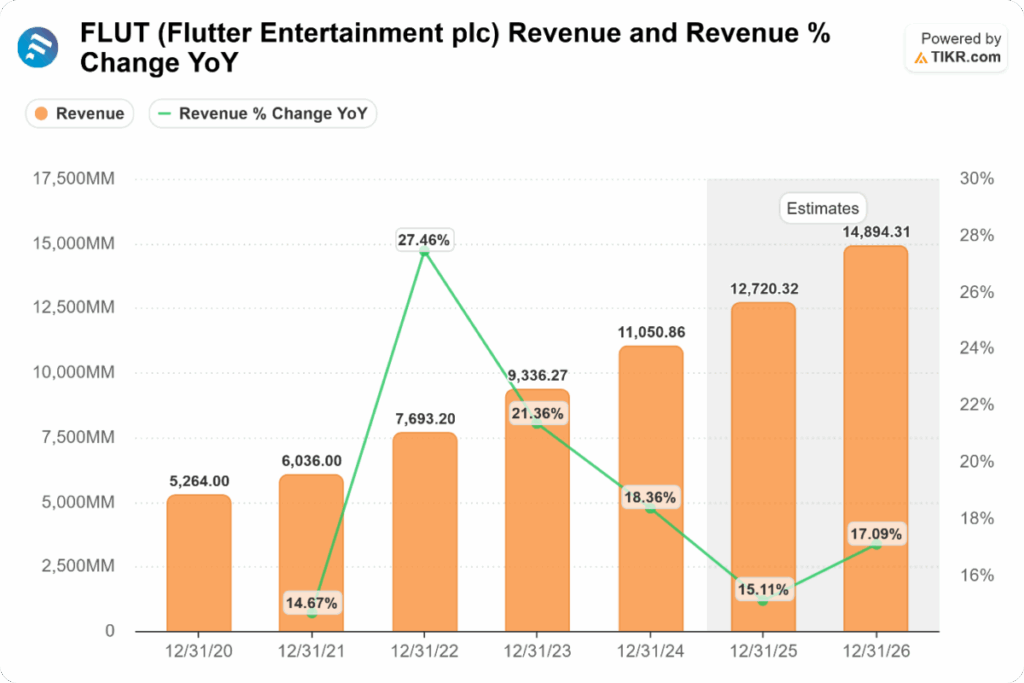

Flutter Entertainment released its Q3 earnings last week, which were a mixed bag. While the company missed topline estimates, it beat the bottom line. Meanwhile, the company lowered its full-year revenue guidance to $16.69 billion, a decrease of $570 million from the previous forecast. It also cut its EBITDA guidance $2.915 billion, which is $380 million lower than the prior guidance.

The other key highlight of Flutter’s Q3 report was the $556 million non-cash impairment charge resulting from the unexpected ban on real-money online gaming in India under the new Promotion and Regulation of Online Gaming Act, 2025.

Meanwhile, the pivot towards prediction markets gained traction last week. TKO Group Holdings, Inc., the UFC’s parent company, announced a multi-year partnership with Polymarket to integrate live prediction market features directly into UFC broadcasts, events, and digital channels.

PrizePicks announced that it has now gone live with prediction markets in collaboration with Kalshi rather than Polymarket, with which it had announced a partnership earlier in the week.

Moreover, FanDuel, which previously withdrew from Nevada, announced last week that it will launch a new app, FanDuel Predicts, in partnership with CME Group as the company expands its prediction markets business.